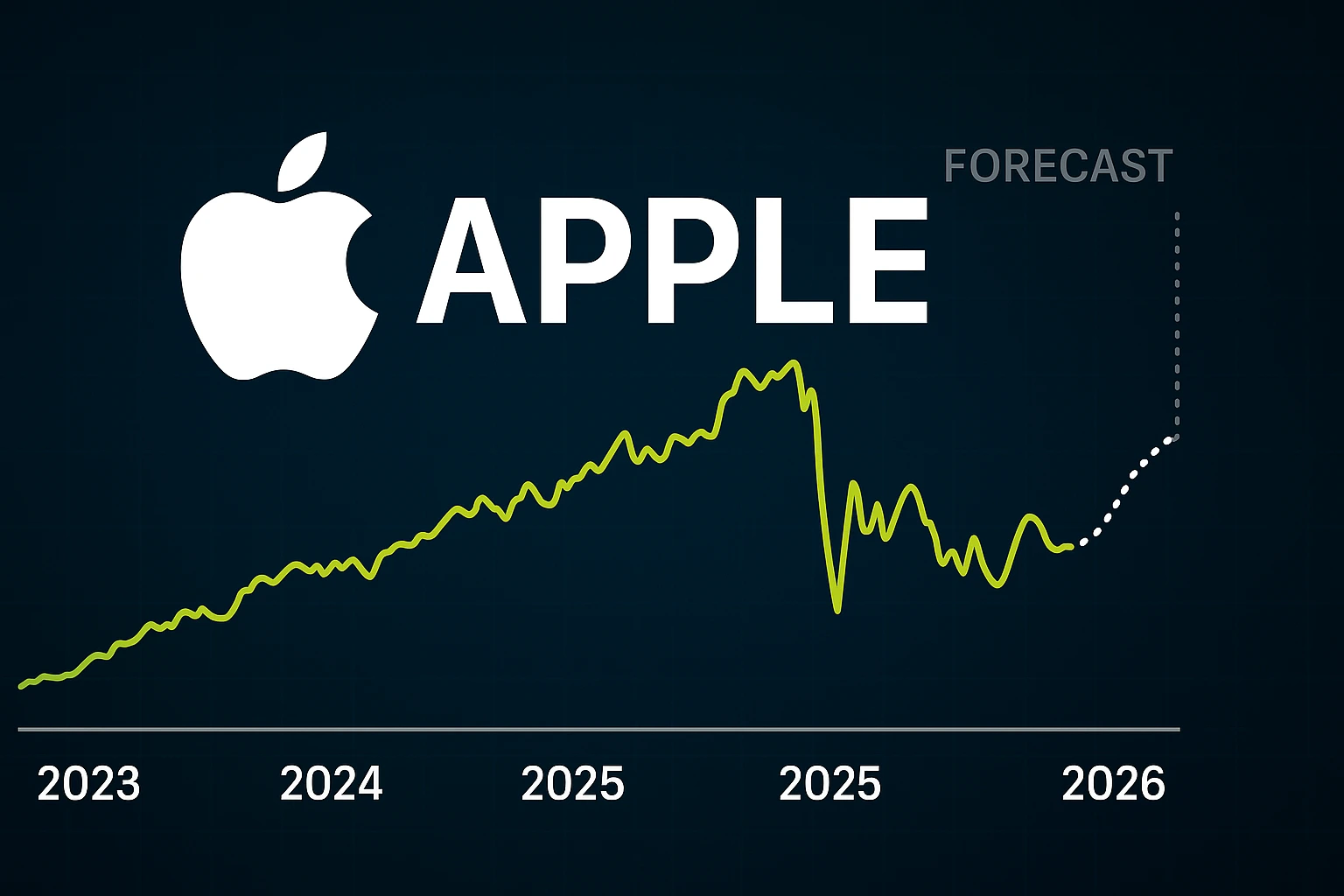

Understanding the future trajectory of Apple’s share price is important for those living in India to make informed investment decisions. This article explores expert opinions and analyses, while also highlighting ways to invest in US stocks from India.

It’s important to consider the opinions of financial analysts and experts in the industry when predicting Apple share prices. These experts examine a variety of factors, such as Apple’s performance on the market, its future growth prospects, and its position in the market. To learn how to invest in US shares from India, Indian investors can use these expert insights as a guide to their investment strategies. Many brokerage platforms provide access to market forecasts and analyst reports, which can be invaluable for making informed investment decisions.

Apple’s quarterly earnings reports are a significant factor in determining the share price. These reports give a snapshot on the financial health of the company and its operational performance. You can anticipate market reactions by staying informed about Apple’s growth in revenue, profit margins and future guidance. Apple’s share price is also heavily influenced by macroeconomic conditions and market sentiment. Investor sentiment can be affected by factors such as interest rate changes, economic growth and global trade policies.

Tim Cook’s vision and leadership are crucial to Apple’s valuation. His strategic decisions and announcements often cause immediate changes in stock prices. Musk’s company updates and public statements are important to follow if you want to understand how to invest in US stock from India. You can use this to gauge the market and forecast future trends in Apple’s share price. Stay informed by following Tim Cook on Twitter and reading the company‘s latest news in your brokerage news feeds.

When investing in volatile stocks such as Apple, diversification is key. You can diversify your portfolio and reduce the risks of single-stock volatility by learning how to buy US stocks in India. To balance your potential risks and returns, you can include a mixture of blue-chip, high-growth companies and exchange-traded fund (ETF) investments. Diversification will ensure that Apple share price your investments do not become too dependent on any one stock.

Another important factor to consider is the tax implications. Taxation applies to dividends and capital gain income from US stocks. Investors in India should be aware of the Double Taxation Avoidance Agreement between India and the US (DTAA), which is designed to reduce double taxation. To know how to invest in US shares from India, you need to be aware of the tax regulations. You can also seek advice from a consultant on tax matters if necessary. You can maximize your investment returns while still complying with tax obligations.

Selecting the right brokerage to invest in Apple or other US stocks is essential if you want to do so from India. The right brokerage will offer you access to US markets and competitive transaction fees. It should also have robust trading platforms and comprehensive research tools.

Apple’s share price forecast is based on a thorough analysis of the financial performance, macroeconomic factors, and market sentiment. Understanding how to invest in US shares from India, and using expert opinions and analyses, is essential for Indian investors. Following these guidelines will help you navigate the complexity of investing in Apple stocks and other US stocks, optimizing your portfolio to maximize potential growth and stability.